In the ever-evolving landscape of modern finance and digital transactions, Mobile Money Guyana (MMG) has emerged as a prominent player, revolutionizing the way people manage their money. Offering a seamless and secure platform for mobile transactions, MMG has garnered attention from individuals and businesses alike.

In this guide, we will delve into the intricacies of MMG, exploring its features and functionalities, so you can make an informed decision about whether MMG is the right fit for your financial needs.

Understanding MMG: An Introduction

Mobile Money Guyana Inc., a wholly-owned subsidiary of Guyana Telephone and Telegram Company (GTT), is Guyana’s sole full-service telecommunications provider. To date, MMG is a cutting-edge mobile money service provider in Guyana, bringing the convenience of digital transactions to users’ fingertips.

With its user-friendly interface and wide array of services, MMG is simplifying financial management for countless individuals and businesses across the country.

Getting Started with MMG: Account Setup

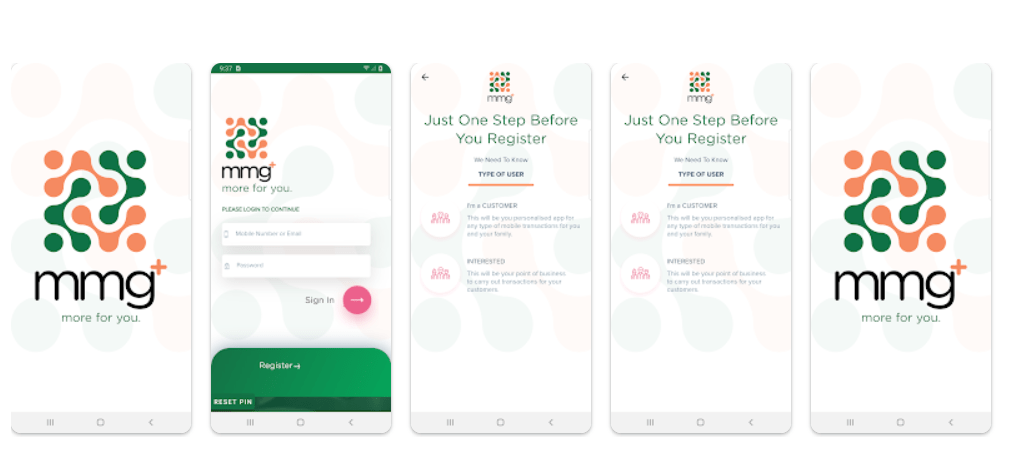

To unlock the full potential of MMG, you need to start by setting up your account.

It’s easy and free to sign up for MMG in Guyana. Just fill out the form under “Register” on this page. You will need a valid ID (like a driver’s license, passport, or ID card), proof of address (from the last 6 months), and your TIN.

Chose to sign up as a business or personal.

Personal: You can have more freedom with your money if you use MMG+. Pay bills, give and receive money, and put money on your phone.

Business: Sign up as a business to accept MMG payments so that your customers can pay you quickly and easily. The app can also be used to pay people.

Funding Your MMG Account

Having an MMG account is just the beginning. You will now need to start putting money in the account.

There are various methods available to fund your account. Whether it’s linking your bank account or credit card for seamless transactions or utilizing physical top-up points for cash deposits, MMG offers flexible options to add money to your wallet.

Wondering how to add cash to your mmg+ wallet right?Well, you have to put down at least $500. And as mentioned, you can do this at any MMG agent, GTT Store, or online banking (GBTI, Demerara Bank). You’ll usually get a text message confirming your deposit, and then you can start using your MMG+ wallet.

Making Transactions with MMG

Sending and receiving money has never been easier with MMG.

How do I pay bills using MMG?

Here are the steps for paying your bills with the MMG app:

- First, you need to launch the MMG app.

- Then, Select “Pay Bills”

- Select Category/Biller

- Now enter the details as prompted.

- Enter the PIN, and then select OK.

- You will receive confirmation of your Bill Payment by SMS

If you choose to use the easy-to-use USSD menu option, here are the steps:

- Using your GTT mobile phone dial *123# and press Send

- Choose “Pay Bill” from Option 2 on the Main Menu.

- Select Category/Biller

- When prompted, enter the information.

- When prompted, confirm the information.

- Enter your PIN correctly.

- You will then receive an SMS confirming the payment of your bill.

How do I send or transfer money using MMG?

To send or make a money transfer using MMG, you will need to follow the basic steps as described above using your mobile device.

As you can see, with just a few taps on your phone, you can conduct secure and swift transactions, making MMG an ideal choice for day-to-day financial activities.

MMG and Digicel Integration

One of the significant advantages of MMG is its collaboration with Digicel, a leading telecommunications provider in Guyana. This partnership enhances MMG’s services, offering a wide network of coverage for seamless transactions.

Managing Your MMG Balance

Keeping track of your MMG balance is essential for effective financial management. It is a good practice to always stay informed about your finances and maintain a healthy MMG balance.

Checking your MMG balance is very simple.

Here is how it is done:

- Open the MMG+ app.

- Go to my wallet.

- Enter your PIN

- Select the View Balance icon in the top left corner.

Alternatively, you can use the USSD menu, which is also simple to use.

- Enter *123# and press Send on a GTT mobile device.

- Pick “My Wallet” from menu option 5 under “Main Menu.”

- Now choose “Check Balance” under Option 1.

- Input your PIN.

- Transaction is now initiated

Redeeming Mobile Money

MMG not only facilitates digital transactions but also allows users to redeem mobile money for tangible goods and services. We’ll explain the concept of mobile money redemption and highlight partnering merchants and establishments that accept MMG payments. Additionally, we’ll discuss how users can maximize their benefits through exclusive discounts and offers available through MMG redemption.

How do I transfer money from your Republic Bank online account to your mmg+ wallet?

By moving money from your RBL accounts to your mmg+ wallets, you can send and receive money online in a safe and reliable way.

To load your mmg+ wallet, follow these steps:

Step 1: Sign in to your Republic Bank account online or with the mobile app.

Step 2: Click “Pay” on the menu bar.

Step 3: Click “Company/Utility Payments.”

Step 4: Choose “Preregistered” if you have already signed up for mmg+. If not, choose “Other” and then tap on “mmg+.”

Step 5: Type in your financial information and click “Next.”

Step 6: Look over your information again and click “Confirm” to finish the process.

Visit Republic Bank to access more information on how to load your mmg+ wallet using RBL Online Banking.

Conclusion

In conclusion, Mobile Money Guyana (MMG) offers a revolutionary platform for seamless and secure mobile transactions. Through this comprehensive guide, we’ve explored the various aspects of MMG, from setting up an account to conducting transactions and exploring its future prospects.

Whether you’re an individual seeking a convenient and efficient way to manage your money or a business owner looking for secure payment solutions, MMG presents a compelling case as a mobile money service provider in Guyana.

Remember to assess your specific needs and preferences, and don’t hesitate to reach out to MMG’s excellent customer support for any assistance you may need. Embrace the possibilities of MMG and take control of your finances today!

FAQs

Is MMG available to all mobile users in Guyana?

Yes, MMG is available to all mobile users in Guyana, regardless of their network provider.

Can I link multiple bank accounts to my MMG wallet?

Yes, MMG allows users to link multiple bank accounts for added flexibility in funding transactions.

Are MMG transactions reversible in the event of mistakes?

While MMG provides a secure platform, it’s essential to double-check transaction details, as most transactions are irreversible.

Does MMG charge fees for checking your balance?

No, MMG does not charge any fees for checking your account balance. It’s a free and convenient service.

Can I use MMG for international money transfers?

At present, MMG primarily facilitates domestic money transfers within Guyana, but international services may be available in the future.

Get Access to the MMG+ App here

Remember, MMG is more than just a service; it’s a gateway to effortless money management and a world of possibilities. Join MMG now and embark on your journey towards financial freedom.

So, do you really need MMG? Let the knowledge gained from this guide help you decide. Embrace the power of mobile money with MMG and experience the ease of managing your finances in the digital age!

Get started with MMG today and discover a new level of financial convenience in Guyana!

Note: The content in this article is intended for informational purposes only. Before making any financial decisions, we advise readers to conduct thorough research and seek professional advice if necessary.